Why DeFi Needs Real Risk Expertise (and How It’s Being Built)

Feb 2, 2026

Robust risk management is crucial for DeFi to power a large part of the global financial system.

Nexus Mutual has been building this risk infrastructure since 2019, grounded in subject matter expertise in insurance alternatives and blockchain, along with a trusted network of partners.

As the leading crypto insurance alternative, we are frequently asked:

How do we price risk?

Is the cost of cover related to gross yield?

How do we assess new listing requests in this fast-moving environment?

Risk Sharing is Collaborative, not Competitive

Insurance, by nature, is not a winner-takes-all industry. It is collaborative and trust-based, often requiring multiple parties to join forces to share a wider variety of risks. This industry builds on a reciprocal trust in each others’ expertise and correct decision-making abilities.

↑ Source

Lloyd’s of London is a perfect example for this collaborative nature, functioning as a marketplace where insurance and reinsurance providers come together to share risk with people, businesses and communities. Nexus Mutual brings this tradition of collaboration and trust to DeFi. The transparency and openness provided by blockchain technology elevates this collaborative nature.

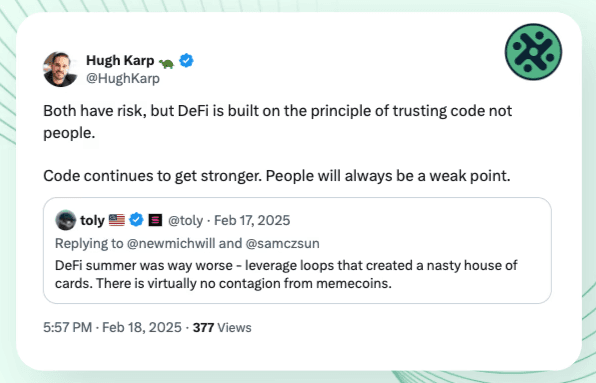

Maintaining trust is at the core of DeFi. Users have to trust in code to enforce correct behavior, align incentives, and penalize fraud without intermediaries. However, the industry’s history of exploits and protocol failures has clearly demonstrated the limits of purely code-based trust. Even extensively audited protocols, built by experienced teams with strong incident response capabilities, remain vulnerable.

Risk Management is its own Discipline

Hardly a month goes by without another hack or attack that proves devastating for the broader ecosystem. After each incident, discussions around risk resurface. What could have been done differently? How do we make sure this does not happen again?

↑ Source

Teams publish post-mortems, we hope better measures are put in place across the industry based on these lessons learned, and then we move on. Until the next failure resets the discussion. At Nexus Mutual, we believe that an expertise in DeFi risk requires both trusted networks and technical capability.

Nexus Mutual as a Nexus of Risk Expertise

Since 2019, Nexus Mutual has been working to develop DeFi risk expertise. Here is our preliminary formula:

Have a team with diverse backgrounds in engineering, insurance and financial markets

Be crypto-native and build onchain solutions, often in collaboration with other crypto-native DeFi teams

Focus on building trust and long-term relationships

Constantly re-evaluate main target audiences to design and ship new products with market fit

To learn more about the concrete steps we’ve taken recently, take a look at our recap of our key progress over the past year.

Structural Gaps -and Opportunities- in DeFi Risk

There are challenges that we frequently face as we continue to build the risk infrastructure DeFi needs. We can, and should, reframe them as opportunities.

There isn’t decades of data on DeFi yet, especially in comparison to TradFi risk. Historical data is still limited compared to the decades of data that traditional insurance businesses use to underwrite risk. However, crypto and DeFi have the advantage of fully transparent and easily accessible data. This allows us to capture and analyze onchain activity in real-time and it gives us conclusive evidence of when loss events occur. This transparency is one reason Nexus Mutual can pay claims in days, rather than weeks or months like traditional insurance.

One last challenge that affects the entire DeFi industry: despite the whole system being built on the premise that human judgement is the weak element in a system fortified by the law of code, we need to be able to identify and work with human expertise. At Nexus Mutual, we’ll always need to talk to the protocol teams and developers that we underwrite cover for. The human element is important. This is also evident in the recent proliferation of vaults: when they are curated by humans, which “code” or “machine” can instill trust in the market participant if the human is hard to trust?

↑ Source

Transparency creates opportunities for seamless, high-impact collaboration. Some of our recent partnerships, like the one with Symbiotic, are set up to enable risk sharing at scale, allowing staked capital to efficiently underwrite a broader set of protocols and asset classes across DeFi. Learn more about this partnership in this CoinDesk article.

Let's make DeFi safer together

Nexus Mutual remains open to collaborating with any new risk expert interested in building real value for crypto and beyond. To learn more about our existing partnerships, check out The Nexus Review 2025 Wrap-up.

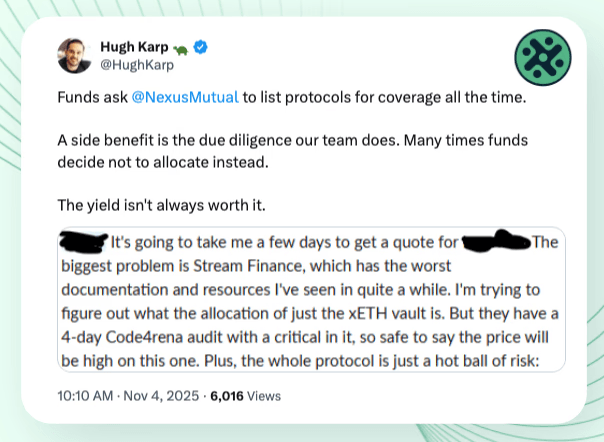

Our formula is simple: we collaborate with everyone. If you’re a protocol team requesting a listing, we evaluate your codebase and documentation free of charge. If you’re an investor, we’re always happy to find a way to protect your assets with our extensive product portfolio and our expertise. On the latter, a remark is due: we’re consistently correct with our predictions.

↑ Source

If you’re ready to put the “low risk” in low-risk DeFi, reach out to us.