Nexus Mutual v3: A Year of Progress in Onchain Risk Infrastructure

Jan 15, 2026

As 2026 kicks off, the Nexus Mutual team wishes our community a safe year in DeFi — one grounded in credible, well-designed alternatives to traditional financial systems. As we prepare for the road ahead, we want to share a quick update highlighting key developments across the Nexus Mutual protocol, UI, and governance.

Building on our founder Hugh Karp’s mid-year progress update on the Nexus Mutual Governance Forum, this piece reflects how those plans have evolved and how they are being implemented. It also serves as a practical entry point for newcomers to our ecosystem, offering a clear view of how Nexus Mutual operates as the risk sharing infrastructure layer for DeFi.

High-level goals for sustained momentum

Since 2019, Nexus Mutual has continuously delivered flexible insurance alternatives for institutional-level DeFi investors. As institutional adoption of DeFi increases, traditional markets have a growing need for additional underwriting capital. To meet this increased demand, Nexus Mutual is working to enter regulated insurance markets.

Another important priority has been the design of new mechanisms to welcome new underwriting capital. A major milestone toward this was the launch of the Ratcheting Automated Market Maker (RAMM) in 2023, a protocol upgrade designed to improve capital efficiency and long-term sustainability. To date, the RAMM has accrued approximately 6,009 ETH (around $16 million) in value for NXM holders. With this foundation in place, Nexus Mutual is poised to attract additional capital from new and existing stakeholders to support the Mutual’s next phase of growth.

From Nexus Mutual v2 to Nexus Mutual v3

Over the past year, Nexus Mutual crossed a structural threshold. What we now refer to as Nexus Mutual v3 is not a single upgrade, but the convergence of claims, capital, and product changes that materially alter how the Mutual operates and scales.

The most consequential shift is the evolution of the claims model. Nexus Mutual moved from an open claims assessment process to a permissioned, expert-led model. This change responds directly to long-standing member concerns around incentives, coordination, and decision quality as the Mutual scales. Claims are now assessed by known, accountable experts, while preserving transparency, escalation paths, and member oversight.

In parallel, protocol economics were re-aligned to better support long-term underwriting. Value captured by the Ratcheting Automated Market Maker (RAMM) will be redirected to NXM stakers, directly rewarding active participation in risk underwriting. We’re also actively laying the groundwork to bridge underwriting capital into regulated insurance structures without compromising the Mutual’s onchain discretionary core.

Together with an expanding product suite and a shifting user base that increasingly includes professional allocators and institutions, these changes mark a clear transition. Nexus Mutual v3 reflects a protocol that is optimizing for scale and durability with a more predictable claims process, aligned incentives, increased capital efficiency, and higher compatibility with regulated markets. This is the foundation for Nexus Mutual’s next phase as onchain risk infrastructure for crypto and beyond.

Key figures: A snapshot of 2025

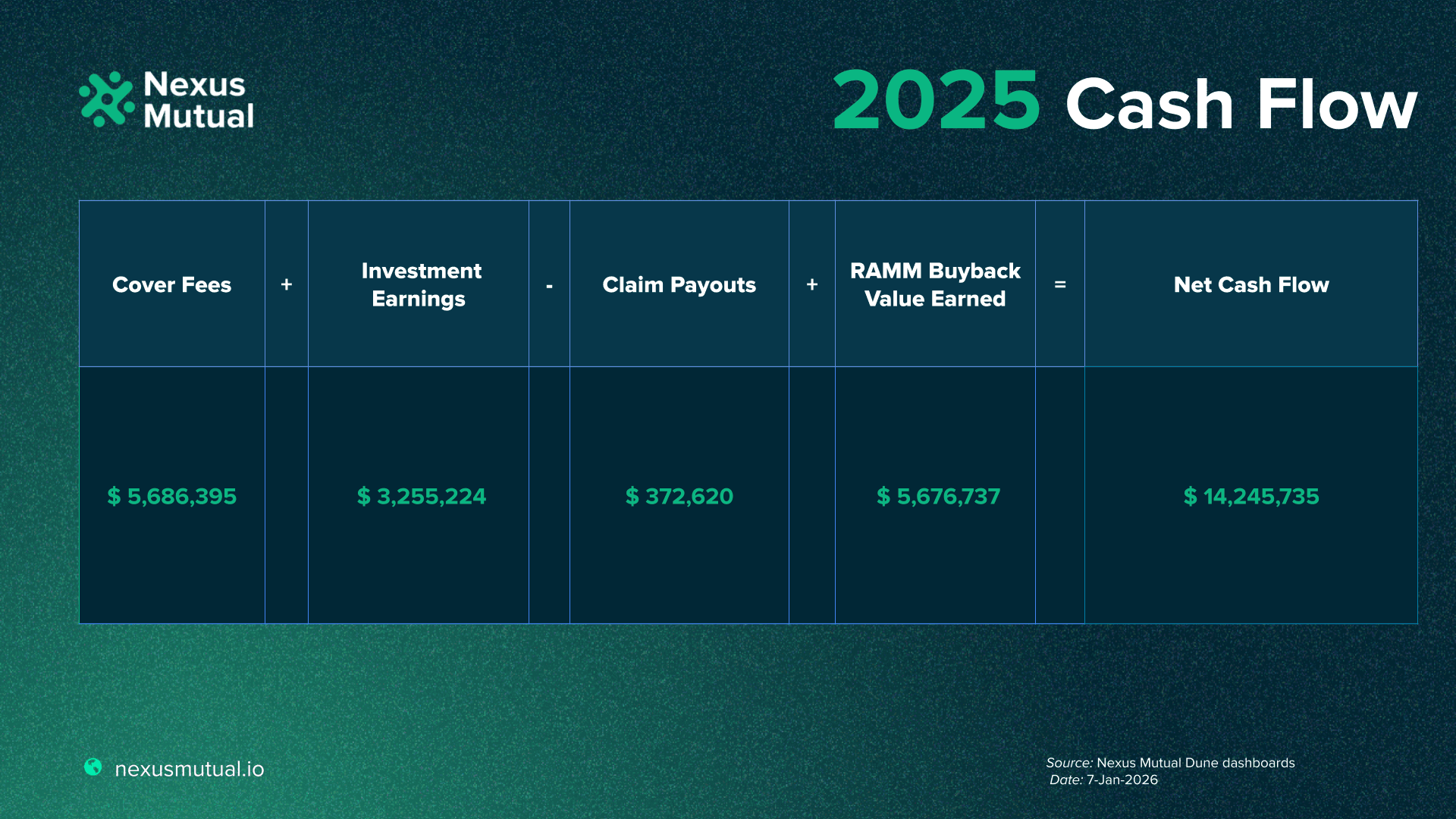

Throughout 2025, Nexus Mutual continued to see steady demand for onchain protection, reflected in cover sales, premiums earned, and claims paid.

In 2025, Nexus Mutual generated over $5.7M in cover fees, alongside more than $3.2M in treasury investment returns and $5.6M+ in value accrued via the RAMM. The Mutual continued to deliver on its core mandate by paying claims, including reimbursements for the Arcadia Finance exploit and the Stream Finance incident. Total claims paid in 2025 exceeded $370K. Overall, Nexus Mutual closed the year with a net cash flow of $14.3M.

Protocol updates

In 2025, Mutual members proposed several protocol-level changes aimed at strengthening trust, clarifying governance, and increasing capital efficiency. Members voted to accept all of the proposals summarized below.

NMPIP-260 | Redirecting RAMM value to stakers: This redesign proposal focuses on incentive alignment: redirecting value captured by the RAMM to NXM stakers, so the protocol directly rewards active participation in underwriting risk. The intended outcome is higher participation in NXM staking, increased total value locked, and greater underwriting capacity. Over time, this mechanism will help strengthen the feedback loop between protocol usage, capital efficiency, and long-term resilience.

NMPIP-261 | Claims and governance reform: This proposal formalized an optimistic governance model for protocol decision-making. It also transitioned the Mutual's claim assessment model from an open model to a permissioned model, where known, trusted experts are responsible for assessing claims all while preserving transparency and accountability in the claims process. As outlined in the proposal, the goal is to reduce friction and ambiguity in claims resolution, to align incentives around timely and well-reasoned decisions, and reinforce trust in Nexus Mutual’s claim's model as the Mutual scales. Read more about our expert-led claim assessment in our documentation.

NMPIP-262 | Bridging capital to traditional markets: This proposal outlined a framework for building regulated insurance cells on top of the core protocol and shifting some of the Mutual's capital pool assets into an insurance entity. The rationale is twofold: diversify risk exposure and unlock additional sources of sustainable returns, while maintaining the Mutual’s primary function as an onchain discretionary mutual. The proposal asked members to give the Advisory Board the power to seek regulatory approval for building regulated insurance cells on top of the Mutual and to make the necessary protocol upgrades required. Once regulators provide clear indications of what changes would be required to support regulated cells, the team will share detailed specifications on the required changes before moving forward.

Engineering updates

Engineering work in 2025 focused on reducing friction, improving usability, and supporting sophisticated cover management.

Cover edits, limit orders, renewals: Recent app updates introduced the ability to edit existing cover positions, place limit orders, and renew existing covers, among other upgrades. These features are designed to give users greater flexibility when purchasing and managing their covers.

SDK: In parallel, the release of the Nexus Mutual SDK enables external teams to integrate Nexus Mutual cover directly into their own products. Nexus Mutual is a composable risk layer within the DeFi ecosystem, and this update is expected to support broader distribution and use cases beyond the Nexus Mutual app in the long-term.

Product updates

Product development continued to expand Nexus Mutual’s coverage across assets, strategies, and user profiles.

Fund Portfolio and Crypto Cover: The Product and Legal teams worked to improve the existing Fund Portfolio Cover product to include protection options beyond just Protocol Cover. Now, Fund Portfolio Cover can protect against protocol, custody, depeg, and slashing risks. To make this type of modular coverage accessible to all members, Crypto Cover was launched. With Crypto Cover, the Product team can add Custody, Depeg, and Slashing listings to meet demand from our members.

Protocol Cover: The Product and Legal teams worked to update our flagship product, Protocol Cover. The latest version of Protocol Cover provides clear definitions for oracle failure, oracle manipulation, and liquidation failure. We also added language that will enable the Mutual to add listings for Non-EVM protocols once the Product and Engineering teams complete an existing project in Q1 2026.

Bug Bounty Cover: Launched in partnership with Immunefi, Cantina, and Sherlock, Bug Bounty Cover gives protocol teams a way to offset the risk of a critical bug bounty payout through their bug bounty program. With Bug Bounty Cover, protocol teams only pay 20% of a critical bug bounty, with Nexus Mutual covering the rest, up to the cover limit. For more information, read the Cover Terms for Bug Bounty Cover.

BTC-Denominated Cover: The launch of Bitcoin-denominated cover marked an important step toward asset-native insurance, allowing BTC exposure to be protected without introducing FX risk for members purchasing cover to protect their productive BTC position in DeFi. Read more about the BTC-Denominated Cover on the Nexus Mutual Blog.

Leveraged Liquidation Cover: Leveraged looping strategies are extremely popular in onchain markets, but the Mutual's existing Depeg Cover wasn't suited to cover the risk of a depeg for a leveraged position. Our Product team worked with our institutional members to create a new cover product to protect leveraged positions against the risk of liquidation due to a depeg, oracle failure, or oracle manipulation event; it also covers against a scenario when an unrealized loss occurs where liquidations do not occur because fixed-rate or hardcoded oracles are used or the position is unprofitable to liquidate.

Sumsub: On the compliance side, Nexus Mutual migrated its KYC provider to Sumsub, improving reliability and scalability.

More products in the pipeline: Looking ahead, additional products are in development, including Kidnap & Ransom (K&R) Cover and the Real-World Insurance Vault (RWIV). The RWIV proposal on the Nexus Mutual Governance Forum explores how insurance-native returns from real-world risk could be made accessible onchain under a carefully structured, vault-style framework.

Capital Pool and Investment updates

In 2025, Nexus Mutual fully repaid its Aave loan once the price of ETH reached $4500 By repaying the Aave loan, the Mutual reduced overall exposure to Aave v3, so staking pool managers were able to underwrite more Aave cover, one of our most popular cover listings.

Mutual members also approved an allocation of 5,160 ETH to the Steakhouse ETH Morpho Vault, enabling measured yield generation under transparent, governance-approved parameters. As with other investment decisions, the goal is to generate consistent returns with low-risk allocations to offset future claim payments and grow book value for NXM holders.

Looking ahead

We invite the community to join our upcoming webinar on Thursday, January 22nd, to review these updates in detail and the direction Nexus Mutual is taking in 2026. Building safer financial infrastructure is a collective effort; one that benefits from shared expertise and open dialogue. Sign up for the webinar here.

If you’re ready to put the “low risk” in low-risk DeFi for your protocol or portfolio allocations, we’d love to hear from you. Get in touch with our team.